KeyBank | Recent Work

KeyBank is a regional bank with a footprint in the Northeast and Pacific Northwest

DESIGN LEADERSHIP & MANAGEMENT

Most recently, I have been managing product designers and leading teams of cross-functional designers to improve experiences across KeyBank’s retail and small business mobile app and desktop website.

Due to the secure nature of banking, some of this work cannot be shared publicly. However, I want to outline some of my team and I’s accomplishments that are currently live.

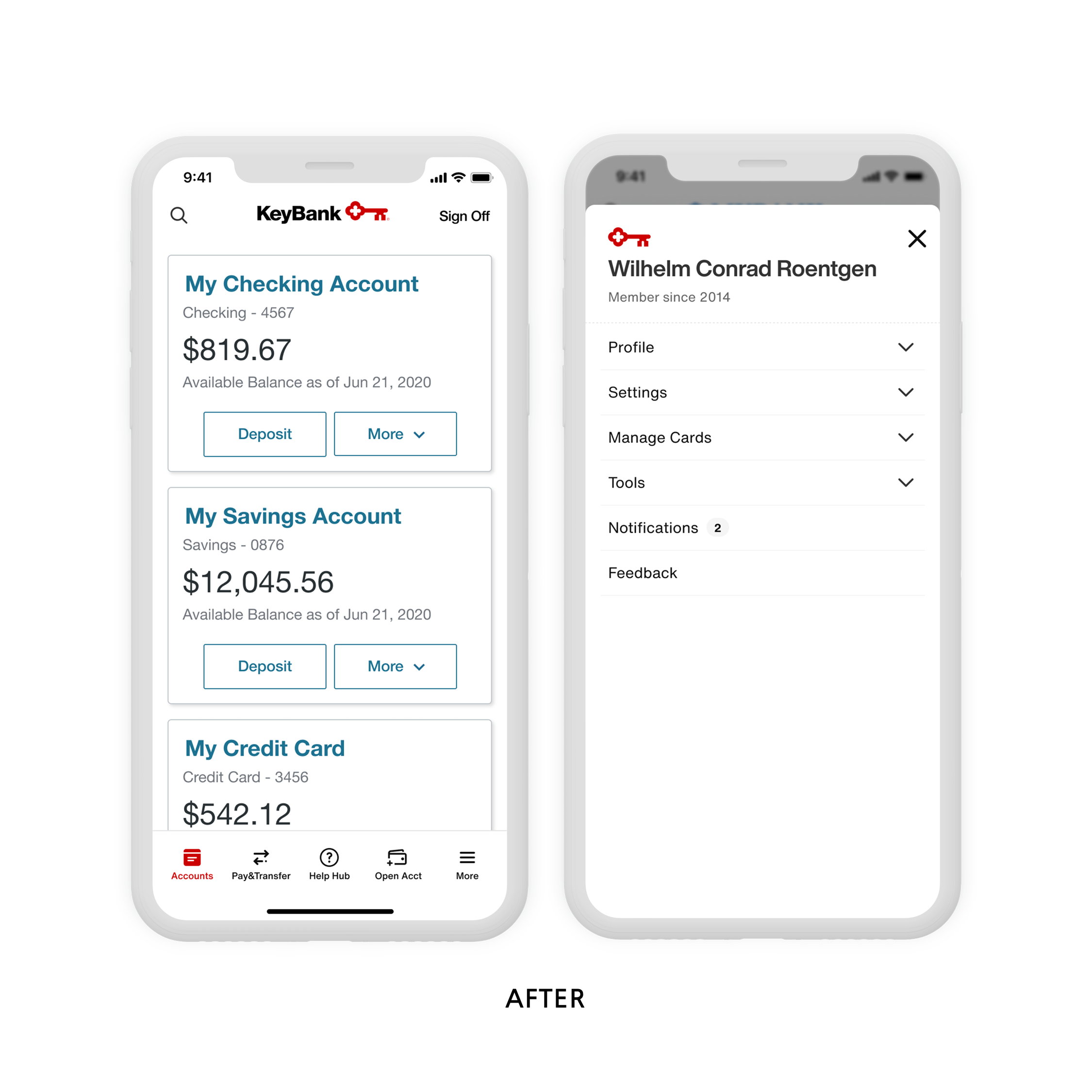

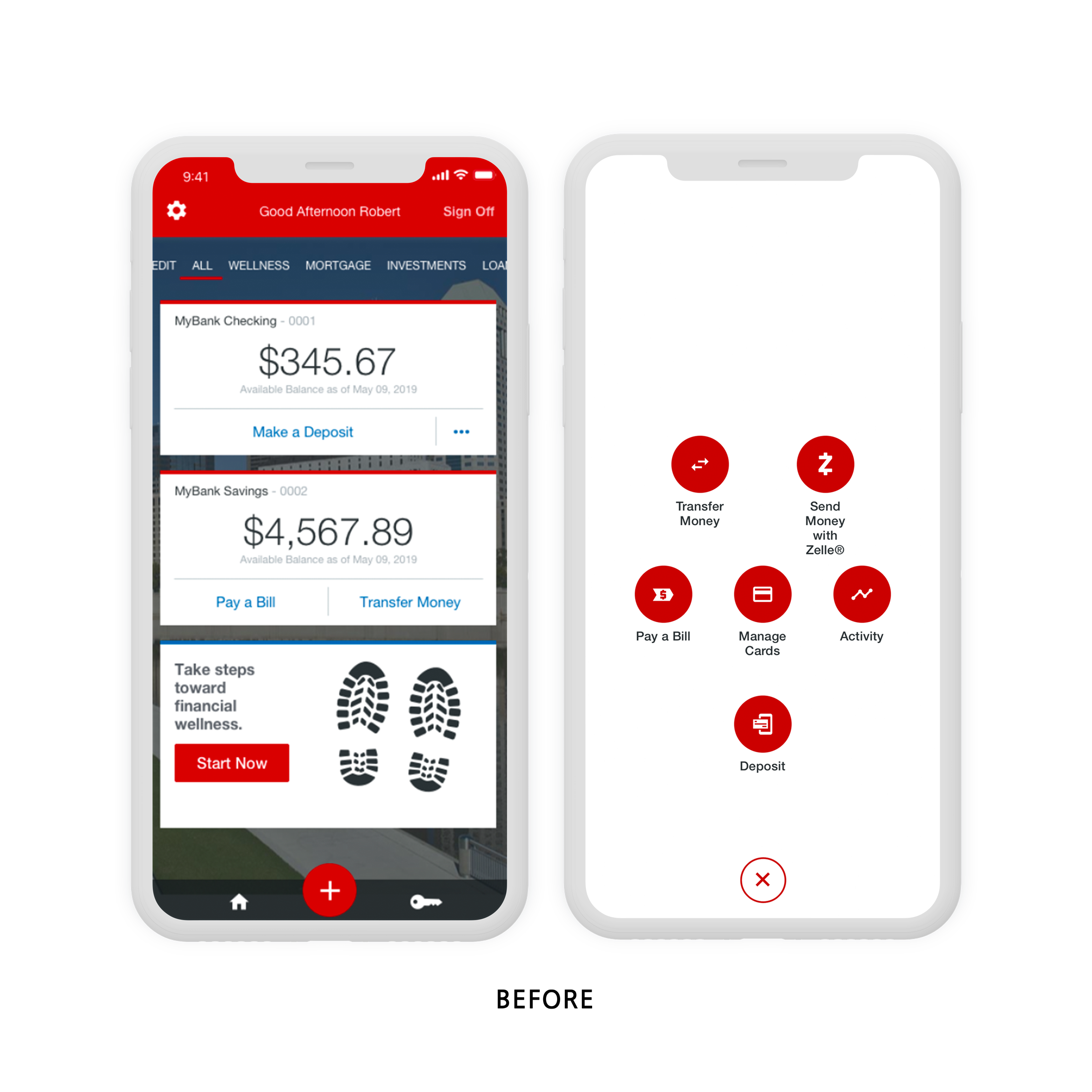

Mobile App Navigation

Leading strategy, research, IA, and UX, while collaborating with product, UI, and copy, we were able to improve find-ability of key features.

The Problem: Clients weren’t finding what they were looking for in the mobile app. This led them to call the call center for help, or leaving negative reviews and feedback about features we didn’t have (that really we did have, they were just hidden).

The Solution: Architect and design an intuitive, scalable mobile navigation system catering to the 3 major ways clients want to find information - account-based, global, and search.

The Results: Created an IA system that could easily be scaled and tested, increasing actions taken in app, reducing call center volume, and increasing mobile NPS.

PAY & TRANSFER REDESIGN

Leading the strategy, research, and execution, I reimagined our pay & transfer flow for the mobile app.

The Problem: Clients could not complete payments or transfers due to confusing UI and complicated, unintuitive flows that could be up to 12 screens long.

The Solution: A single page solution where clients could make payments and transfer money quickly and easily - almost without having to think about it.

The Results: Our first “mobile-first” initiative that helped drive the narrative for mobile-optimized experiences, reducing call center volume, increasing success rate of payments and transfer, and increasing NPS for “Ease to complete your transaction” by 10%.

PPP LOAN PROGRESS TRACKER

With 2020 being, well, 2020, my team often had to pivot (like Friends-style PIVOT) when needed.

Working with a small, dedicated team of engineering, product, copy, lines of business, and executive leadership we were able to turn around a PPP Loan Progress Tracker in just 1 week. Giving some much-needed relief to our call center and some peace of mind to our clients waiting on their approval status.

The Problem: Clients felt they had no insight into how or when their PPP loan application would be approved or denied. This overwhelmed the call center, who also had little insight into loan status or the process of approval.

The Solution: A “pizza tracker” for your loan. After applying for a PPP loan our clients would receive a link to check on the status of the loan. This page would not only indicate where in the process their loan was, but gave a little additional context as to what happens during this step.

The Results: More than 43k PPP loans serviced, reducing call center volume, and increasing client satisfaction.